Caveat

This paper presents a selection of recent practices employed in the field of asset recovery. The five practices highlighted were selected in consultation with the enquirer and should not be considered exhaustive or representative of all developments in the wider field. There are many other recent practices which are widely used and relevant but not covered here. For example, the practices featured in this paper pertain to the tracing, freezing and confiscation stages of asset recovery, but do not address the equally important step of the return of assets.

It should be further noted that, while the topic of asset recovery is relevant for a range of criminal offences, this paper focuses on recovery of assets deriving from corruption.

Query

Please provide a summary of five emerging asset recovery practices.

Introduction

The Basel Institute on Governance (n.d.) states asset recovery as “involves the confiscation of illicit assets, usually the proceeds of crime, and the return of these assets to the legitimate owner(s)”. Such assets include funds which have been embezzled by public officials, as well as material assets purchased with the proceeds of corruption, for example, real estate. Ensuring that corrupt actors can no longer access and enjoy these assets not only creates a deterrent effect against corruption but facilitates the return of these assets to the original jurisdictions and victims of the corruption, which can constitute a significant source of fiscal income, especially for low and middle-income countries.

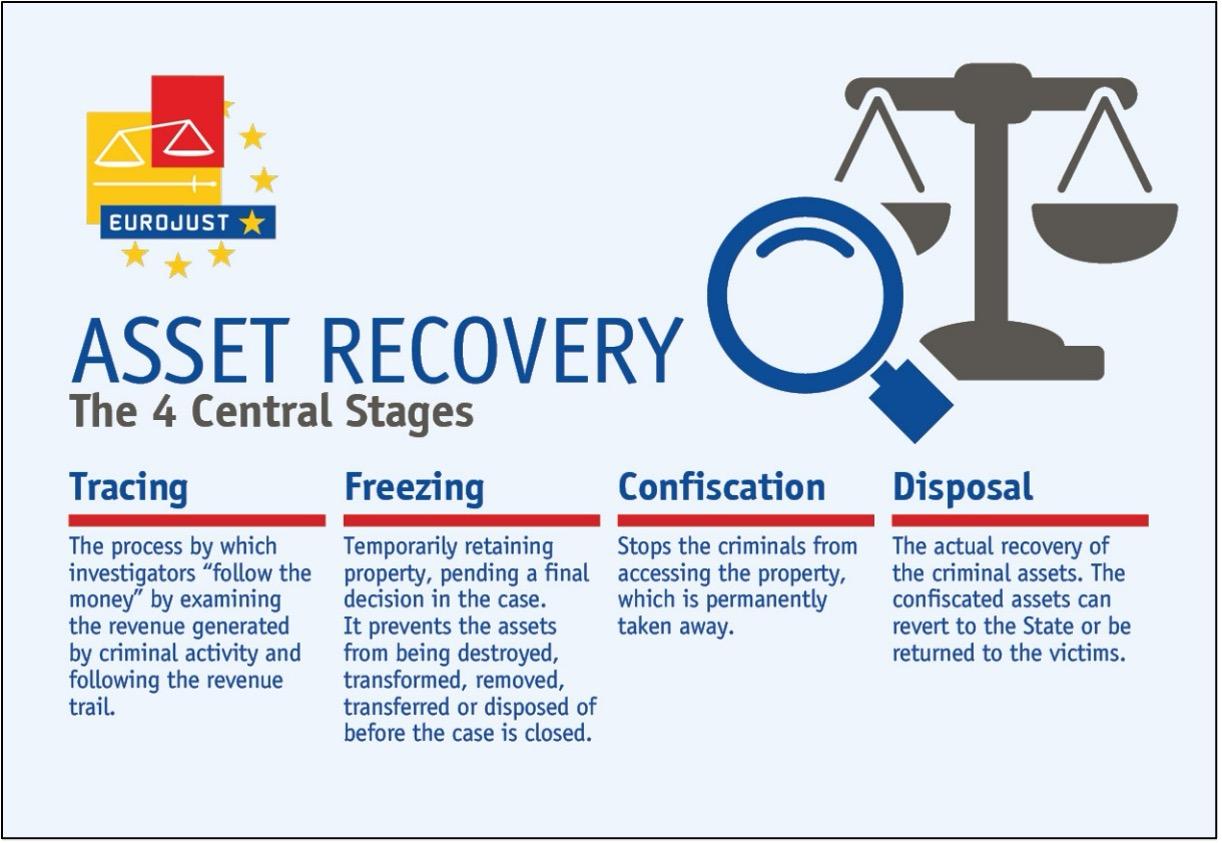

According to Eurojust (2019), asset recovery can be broken down into four main stages: tracing, freezing, confiscation and disposal (often known as return or repatriation). Each of these are explained in more detail in Figure 1.

Figure 1: The main stages of asset recovery

Sourced from Eurojust 2019.

Due to its multi-jurisdictional nature, asset recovery relies heavily on international cooperation between criminal justice actors active in different countries. Cooperation has been aided by establishing asset recovery inter-agency networks, mutual legal assistance treaties and multilateral instruments. Borlini and Nessi (2014: 8) state that the adoption of the United Nations Convention against Corruption (UNCAC) in 2003 marked a watershed moment as it ensured the recovery and return of assets became a widely accepted principle at the international level. Chapter V of the UNCAC sets out states’ commitments on recovering assets deriving from the commission of any of the corruption offences listed in the convention.

Furthermore, asset recovery is a cornerstone of the Financial Action Task Force (FATF) anti-money laundering regime. FATF Recommendation 4 requires countries to adopt measures to enable their competent authorities to freeze and seize assets,2101b1fdb669 while Recommendation 38 requires them to have the authority to take expeditious action in response to asset recovery requests by foreign countries. In 2023, the FATF amended these recommendations to strengthen the obligations even further and require countries to treat asset recovery as a priority at the domestic and international levels.

Stephenson et al. (2011: 2) note that there are aspects of asset recovery which cannot be addressed through conventions alone. Indeed, global progress has been limited, with one estimate indicating that less than 1% of total criminal proceedsf4cc815eb3d2 have been recovered (RUSI n.d.). Another clear indication of the need to go beyond conventions is that asset recovery rates remain effectively stagnant in some jurisdictions (RUSI n.d.).

This can be explained by various barriers to recovering assets in practice. For example, when assets are identified, it is critical to freeze them swiftly to prevent the suspect from using, selling or moving them. However, the multi-jurisdictional nature of asset recovery, especially via unclear or cumbersome mutual legal assistance (MLA) processes, can lead to communication and coordination issues between authorities and preclude urgent asset freezing (Borlini and Nessi 2014: 37).

Freezing, confiscation and disposal can all be hindered by the state’s self-interest and lack of political will. For example, economic interests or bank secrecy laws may lead some states to fail to prioritise international asset recovery and neglect (or even prevent them from) responding to other states’ requests for assistance (Stephenson et al. 2011: 24).

All stages of asset recovery tend to be labour intensive and require the investment of significant resources. However, competent authorities are generally under-resourced across high, low and middle-income countries alike (Stephenson et al. 2011: 31). On top of this, there can be a lack of personnel qualified to effectively conduct financial investigations and prosecute asset recovery cases, which also largely arises from a lack of adequate investment (Stephenson et al. 2011: 31).

Furthermore, the playing field is constantly changing. For example, tracing assets has become more difficult with many corrupt actors becoming more sophisticated in concealing their spoils, including by using complex money laundering schemes and financial structures with support from enablers such as lawyers and accountants (ICAR 2019: 4). Other recent technological developments, such as virtual assets and cryptocurrencies, have given such actors new options to launder and conceal funds (ICAR 2019: 4).

In response to such barriers and the changing environment, the Civil Forum for Asset Recovery (CiFAR 2020) notes that there have been calls for states to move away from criminal justice approaches and to “use new, non-traditional tools to make case-work more effective and faster”. Indeed, many states have started to use “less established mechanisms”, which, as Dornbierer (2024) suggests, can act as a source of inspiration for other states looking to increase their recovery success rate.

This Helpdesk Answer provides an overview of five practices employed in various jurisdictions in the processes of identifying and tracing, freezing and seizing assets, especially over the past 15 years. It is important to note these five practices pertain primarily to the tracing, freezing and confiscation stages of asset recovery but do not address the disposal or return of assets stage, which is equally important and also faces many legal and political hurdles.b86c1635aad9

This description of these practices should not be interpreted as constituting an endorsement of these practices under all circumstances. The Council of Europe (2020) has stated that there is no “one-size-fits-all” approach to recovering assets, and that there are different pathways to do so, depending on the specificities of the case and jurisdictions involved.

In this vein, Dornbierer (2024) cautions that before introducing new practices, it is necessary to assess that they “do not unreasonably infringe on established rights such as the right to enjoyment of property or the presumption of innocence”. Additionally, he notes that the adoption of any new practice is unlikely to be effective unless adequately resourced.

In conclusion, virtual assets provide a possible avenue to launder the proceeds of corruption due to their relative anonymity thus requiring the enhanced attention of and response from law enforcement and anti-corruption actors. Hence, greater investment into in-house capacities and the use of third-party specialists can help such actors to effectively trace these assets.

Five emerging practices in asset freezing, tracing and confiscation

Using artificial intelligence (AI) and machine learning (ML) to support the tracing of assets

Aarvik (2019) defines artificial intelligence (AI) as a set of technologies where “machines mimic human intelligence to solve complex problems”, for example, by means of machine learning (ML), where algorithms can be “trained” on how to handle data. As a new and emerging technology, many uses of AI and ML for asset recovery are of a more speculative nature at the time of writing; for example, Chandrawat & Partners (n.d.) argue that by applying machine learning to historical data, it could become possible to predict future asset movements and identify the locations in which illicit assets may be hidden.

However, where these technologies have already broken ground is in the detection of suspicious transactions or asset-related anomalies. As per the FATF recommendations, financial institutions and designated non-financial businesses and professions (DNFBPs) must file suspicious activity reports (SARs) to local financial intelligence units (FIUs). Pavlidis (2023) stresses that ensuring that these FIUs can accurately analyse filed SARs is an important precondition for tracing assets if investigations are later launched. However, using traditional methods tends to be very labour intensive, considering the sheer volume of SARs submitted. In this regard, AI-powered tools offer strong potential by automating the data mining of the SARs and accelerating the detection of anomalies and the identification of potentially illicit assets (Chandrawat & Partners n.d.). In other words, such tools can enrich the SAR data obtained on potential corruption related transactions and thus help flag them to investigators more quickly.

Respondents to a survey issued by FATF (2021b: 21) submitted that one of the main benefits of new technologies such as AI is that they release human resources from processing to do more critical, analytical work. Accordingly, they can be effective in upholding the importance of timing and swift action at the asset tracing stage (InformaConnect 2022)

Several states have initiatives in this regard, which, though mostly in the early stages of deployment, have shown some promising results.

European Anti-Fraud Office (OLAF)’s use of natural language processing (NLP)

In 2021, the European Anti-Fraud Office (OLAF) reported it was in the process of building a system relying on natural language processing (NLP) to analyse large datasets for suspicious transactions. NLP is a subset of machine learning used to help machines understand and manipulate human language. Whereas the scoping of datasets is typically carried out through basic keyword searches, the International Centre for Asset Recovery (ICAR) (2019:79-80) argues that applying NLP can ensure such searches take better account of semantic patterns and language rules, therefore making it possible to pinpoint assets more quickly and accurately. For example, they describe how NLP would be more adept at tracing links across various sources of publicly available data, such as wealth disclosure reports and commercial data sources. Instead of red flagging specific words, OLAF’s system learns from semantic rules to detect suspicious language, such as the following sentence: “Please delete your e-mail after reading”. The system also “learns” when hypothesised suspicious language was correctly detected, thereby continually improving outcomes.

European Parliament 2021

The Financial Crimes Enforcement Network (FinCEN), the US’s national FIU, implements an AI-powered system that enables it to receive SARs and automatically scan for information about a suspect in over 60 government and commercial databases simultaneously (Busol 2020). FinCEN also uses artificial intelligence to prepare reports when evidence corroborates a SAR (Busol 2020). By completing such fraud checks in near real-time, FinCEN found the system expedited the recovery of potentially fraudulent payments, as well as arrests by law enforcement (US Department of Treasury 2024a). The Department of Treasury stated that the system had enabled it to withstand significant increases in fraud-related SARs filed and to recover over US$375 million since it began implementation in early 2023 (US Department of Treasury 2024a).

In 2023, FINTRAC, Canada’s national financial intelligence agency, announced it would also start applying AI to improve its detection of suspicious transactions (Balu 2024). Odilla (2023) describes how law enforcement agencies in Brazil leverage AI to mine large datasets on public spending in order to generate leads on potential corruption (rather than directly trace assets).

Nevertheless, certain drawbacks and concerns relating to AI and ML systems have been raised. The systems may be inoperable or ineffective if the databases they analyse do not contain extractable data or if there is a lack of unique identifiers to identify the same suspect across databases (European Parliament: 2021: 14-15). If controls are not embedded in the design of such tools, their potency may lead to violations of privacy standards (Chandrawat & Partners n.d.). Odilla (2023) also notes the risk that forms of algorithmic bias led to the identification of false red flags. They also found that, in Brazil, there was a general lack of transparency around the functioning and use of such tools. Indeed, others have noted that, due to the technical expertise required, it can be difficult for laypeople to understand AI systems (InformaConnect 2022). Lefer and Sommerer (2024) have raised concerns about whether AI-generated alerts can meet the criminal standards of probable cause and provide a legitimate basis for follow-up measures.

Armenia’s tool for analysing asset declarations

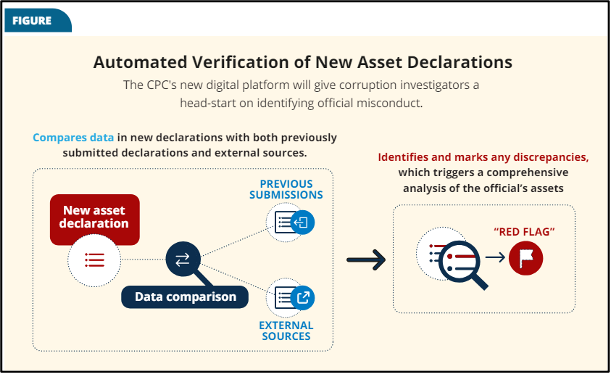

In Armenia, the Corruption Prevention Commission (CPC) had operated a digital system to analyse asset declarations filed by politicians and civil servants. Still, it was reportedly unable to handle the volume of incoming data, leaving most declarations essentially unprocessed. In 2023, the CPC replaced this with a system relying on AI and ML, which streamlined data collection and searchability and automatically flagged discrepancies to detect possible conflicts of interest and other corruption offences. One of the ways it does this is through an automated verification function that compares data in newly received declarations with previously submitted declarations as well as information contained in other state agency databases (see Figure 2).

Figure 2: CPC’s automated verification of asset declarations

Sourced from Harutyunyan 2023: 23.

The chair of the CPC emphasised the importance of the tool, enabling public accountability while respecting privacy rights. For this reason, it was decided to make the raw data of the asset declarations publicly available. Still, conversely the public is not able to tell if a declaration had been flagged as suspicious by the AI tool (Eurasianet 2023).

In conclusion, while the full potential of emerging technologies remains perhaps untapped, some jurisdictions have started using artificial intelligence and machine learning to overcome resource challenges and support the mining of large volumes of data, including suspicious activity reports and asset declarations. These tools can proactively identify red flags and provide law enforcement with potential leads and actionable intelligence for asset tracing.

Enhancing capacities relating to virtual assets

Virtual assets constitute a new addition to the criminal toolkit that requires the development of new capacities from asset recovery actors. The FATF (n.d.) defines virtual assets as “any digital representation of value that can be digitally traded, transferred or used for payment”. This encompasses cryptocurrencies such as Bitcoin and Ethereum, as well as other assets such as non-fungible tokens (NFTs) (Basel Institute on Governance 2022a).

Certain features of virtual assets can make it difficult to attribute ownership of a virtual asset, an asset transaction or any address in receipt of an asset to a specific individual, which naturally obstructs asset recovery. For example, users can encrypt their digital wallets to store virtual assets or the cryptocurrency exchange accounts used to launder conventional currencies (Balthazor 2018: 1210). Additionally, many transactions of virtual assets can effectively occur without the involvement of third-party intermediaries (Balthazor 2018), meaning there is an absence of customer identification and verification measures which in turn creates tracing and identification challenges (FATF 2021a: 16).

Some cryptocurrencies, such as Dash, are fully anonymous (Katsios and Blatsos 2023: 296). Others, such as Bitcoin, one of the most widely used cryptocurrencies, are pseudo-anonymous because transactions can be traced by analysing the public blockchain ledger underpinning it, although this requires specialised forensic techniques (Katsios and Blatsos 2023: 296; Balthazor 2018: 1227-1228; FATF 2021a: 52).

Alnasaa et al. (2022: 3) argues that this relative anonymity (or pseudonymity) makes virtual assets an attractive vehicle to launder proceeds of crime, including corruption. For example, a corrupt official may attempt to obscure the origin of bribes they have received by transferring the money between cryptocurrencies and fiat currencies (Basel Institute on Governance 2023). One estimate indicated the volume of illicit funds circulating in cryptocurrencies in 2021 was US$14 billion (Basel Institute on Governance 2022a). It is difficult to estimate what portion of this pertains to corruptionas there is only sporadic evidence at the time of writingof the use of virtual assets to pay bribes or launder the proceeds of corruption. Nevertheless, more and more cases are emerging, indicating a vulnerability (see, for example, US Department of Treasury 2024b; Spiegel 2024).

Several authors argue that the same legal frameworks and principles applied to recovering tangible assets and conventional currencies can be applied to freeze and confiscate virtual assets (Balthazor 2018: 1218; Basel Institute on Governance. 2022b). The central challenge they highlight is one of low capacity, especially in terms of tracing and attributing ownership of virtual assets, as well as using international legal cooperation channels for such a technical subject matter.

Such capacity issues translate into different virtual asset recovery rates globally. The US has invested substantially in capacity development and its competent authorities have made the largest seizures of virtual assets; for example, a single seizure in 2022 amounted for up to US$3.6 billion. In contrast, many countries, according to the FATF, do not possess the capacity to detect and prevent the laundering of virtual assets (Basel Institute on Governance 2022b). For example, African countries have not carried out significant seizures despite the growing use of cryptocurrencies on the continent (Basel Institute on Governance 2022a). This creates significant money laundering risks as some of the most prominent cryptocurrency exchanges are located in small jurisdictions with low capacities (Basel Institute on Governance 2022a). That being said, the investment in capacities is resource-intensive and must be balanced against developing countries’ other asset recovery priorities.

In this vein, Europol (2022) stresses the importance of capacity development at regional and international levels to ensure counterparts across borders can communicate and coordinate on cases involving virtual assets. They recommend developing standard operating procedures for locating such assets and holding more events and workshops for law enforcement and other stakeholders. Similarly, the Basel Institute on Governance (2022b) emphasises the need for holistic capacity development efforts, which target law enforcement, prosecutors and the judiciary, but also regulators. Such actors should know how to legally handle virtual assets or else risk generating inadmissible evidence for later confiscation attempts in court (Katsios and Blatsos 2023: 298).

Digital Asset Coordinator (DAC) Network

In 2022, the Digital Asset Coordinator (DAC) Network was launched by Executive Order. This is housed in the National Cryptocurrency Enforcement Team (NCET) of the US Department of Justice and comprises 150 designated federal prosecutors. The aim of the network is to provide a forum for “prosecutors to obtain and disseminate specialised training, technical expertise, and guidance about the investigation and prosecution of digital asset crimes”. This includes knowledge generation on the application of existing regulations to virtual assets, new virtual asset issues and how to operate cross-border investigations. These federal prosecutors then act as their respective attorneys’ offices subject matter experts on virtual assets and provide legal guidance to ensure that relevant cases are moved forward and administered in line with due process.

(US Department of Justice 2022)

One means of addressing low capacity is to leverage third-party expertise; for example, companies that specialise in virtual assets and conducting forensic investigations. The Basel Institute on Governance (2022b) stresses the importance of cooperation with so-called virtual asset service providers (VASPs) which are, for example, the entities behind the platforms used to exchange cryptocurrencies. Attribution may become easier when cryptocurrencies are laundered back into fiat currencies, meaning cooperation with VASPs can lead to freezing or confiscation of assets (Basel Institute on Governance 2022b).

The FATF (2021a: 50-51) recommends the use of third-party analytics, such as blockchain analysis, provided that the data collection respects privacy standards. The Basel Institute on Governance (2023) explains that there are firms which, for a fee, will analyse blockchain ledgers and obtain geolocation data or information on which cryptocurrency exchange was used for a particular transaction, therefore making attribution possible (Basel Institute on Governance. 2023). For example, in 2020, US law enforcement obtained the services of a firm that enabled them to effectively attribute Bitcoin transactions to two specific addresses (Katsios and Blatsos 2023: 296).

However, Dolny and Dugas (2022) caution against neglecting the role of the judicial system in the recovery of virtual assets in favour of private actor-led processes, which are more “opaque”. This suggests a strategic approach, which may be to combine third-party specialisation with the development of in-house capacities of criminal justice actors.

Asset-freezing sanction regimes

CiFAR (2021:8) describes asset asset-freezing sanction regimes as unilateral measures imposed by jurisdictions in the framework of their foreign policy that “freeze the assets of persons accused of the misappropriation of state funds, prohibit any funds from being made available to them and sometimes also ban them from travelling to the sanctioning country”. Additionally, financial institutions such as banks will likely be obliged to prevent transactions to or from accounts relating to the sanctioned individual or entity (Oldfield 2022).

CiFAR notes that sanction regimes with asset recovery elements represent a small subset of the wider set of sanctions used to address corruption (CiFAR 2021: 2). Such regimes should also be distinguished from sanctions which are imposed for a host of other foreign policy issues not directly related to corruption.

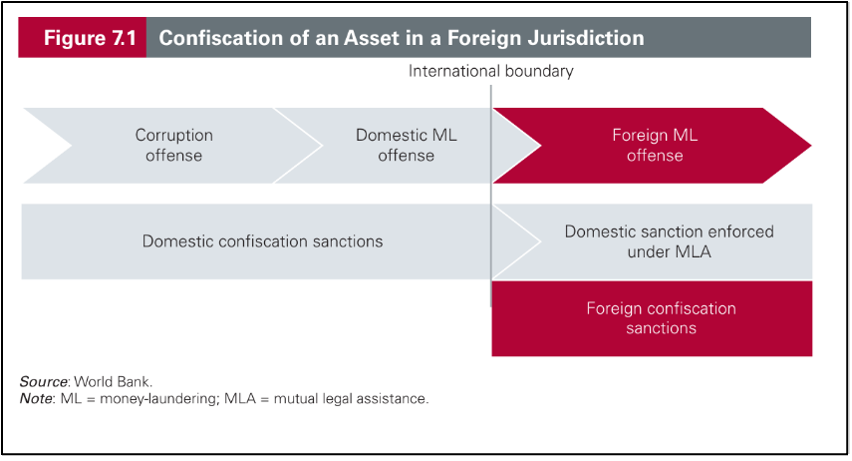

Sanctions can be used to target corrupt actors associated with a regime from a particular country, but may also be broader by, for example, targeting individuals suspected of grand corruption (CiFAR 2021: 7). As indicated by Figure 3, they can provide the basis for freezing and confiscation of assets linked to both domestic and international money laundering, where corruption is a predicate offence.

Figure 3: Confiscation of an asset in a foreign jurisdiction

Sourced from Brun et al. 2021: 210

Asset-freezing sanctions are typically executive measures imposed by a government, meaning they do not follow the formal judicial processes for asset recovery (Oldfield 2022). They typically result only in the freezing of assets and need to be followed up with formal investigations for permanent confiscation to be achieved.

Indeed, a novel aspect of these sanctions is that they can be used by governments as grounds to proactively freeze assets belonging to suspected corrupt officials even before any MLA request from a foreign jurisdiction is received (CiFAR 2021: 4). This can help circumvent the typical timing issues; for example, sanctions imposed on Tunisian officials suspected of misappropriation by the European Union and Switzerland led to rapid freezing and eventually successful recoveries (CiFAR 2021:19).

Furthermore, sanctions may be accompanied by an increase in technical assistance towards the investigation of cross-border corruption (CiFAR 2021:21). For example, international partners supported Tunisia in establishing a special committee for the recovery of stolen assets which spearheaded coordination between national competent agencies (CiFAR 2021:19).

Since the early 2010s, several jurisdictions have deployed asset-freezing regimes. Figure 4 provides an overview of a number of individual listings under such regimes as of 2023.The United States is the currently most active jurisdiction in terms of using anti-corruption sanctions and has listed 108 individuals and legal entities under the Global Magnitsky Human Rights Accountability Act (France 2023: 18-19; CiFAR 2023).

Table 1: CiFAR’s summary of 2023 changes to its sanctions watch database

|

Regime |

Removals |

Additions |

Total Corruption Designations in Dec 2023 |

|

US Global Magnitsky Human Rights Accountability Act |

0 |

11 |

108 |

|

UK Global Anti-Corruption Sanctions Regulations |

0 |

7 |

39 |

|

EU misappropriation sanctions Tunisia |

0 |

0 |

35 |

|

EU misappropriation sanctions Ukraine |

0 |

0 |

3 |

|

Canadian Freezing Assets of Corrupt Foreign Officials Act |

0 |

0 |

24 |

|

Canadian Justice for Victims of Corrupt Foreign Officials Act |

0 |

3 |

55 |

|

Swiss Foreign Illicit Assets Act (Ukraine) |

8 |

0 |

0 |

|

Total all regimes |

8 |

21 |

264[1] |

[1] CiFAR (2023) explains that “[t]he total number of listed individuals is lower (230) than the number of designations (264) because some individuals are designated multiple times, across different jurisdictions.”

Sourced from CiFAR 2023 (CiFAR states it updates this database every six months).

Although the use of asset-freezing sanctions is becoming more prevalent, several concerns have been raised around them; for example, that the anti-corruption aspiration of such sanction regimes may end up subordinate to geopolitical concerns, leading to politicised listings (Oldfield 2022), or that the criteria for sanctioning an individual or entity may not require the same evidentiary standards present in traditional asset recovery investigations (CiFAR 2021:23).

Several authors have expressed reservations about amendments introduced to Canadian legislation in 2022 which would enable the Canadian government to directly confiscate the assets of an individual they considered to constitute a “grave breach of international security” (Ventura 2022; Nizzero 2024). As of 2024, this power had not been used, although several Canadian legal professionals participating in a Royal United Services Institute’s roundtable reportedly said they expected it would face significant legal challenges (Nizzero 2024). For example, the lack of judicial oversight over the exercise of this power has been questioned, as well as the fact that such sanctions are often based on sensitive intelligence which may be inadmissible as evidence in court (Dornbierer 2023: 19; Nizzero 2023: 2).

This highlights the importance of embedding checks and balances on the authority to impose sanctions into the regime.

Australia’s regime

After adding anti-corruption grounds to its autonomous sanctions’ regulations in 2021, Australia has one of the newest asset-freezing sanction regimes. Under the regime, the minister for foreign affairs approves the imposition of sanctions against an individual or entity complicit in an act of corruption considered “serious”. In deciding whether the conduct qualifies as serious, the minister has recourse to several factors, including the status or position of the person or entity and the possible secondary impacts in the affected country and region. The minister must obtain written agreement from the attorney-general and consult relevant other ministers. The sanctions also apply to immediate family members, persons or entities deriving financial benefit from the suspect. Freezing prohibits the owner or any third person from using, selling or moving assets. Under the regime, sanctions are automatically lifted after three years unless they have been formally extended.

(Department of Foreign Affairs and Trade, Australia n.d.; Oldfield 2022)

Likewise, there have been concerns about the long-term sustainability of sanctions. Oldfield (2022) finds that jurisdictions may “face legal and political challenges” to their efforts to move from freezing to confiscating the assets, often because they have not accompanied sanctions with thorough investigations. Furthermore, individuals subject to sanctions often employ legal teams to contest their sanctions and prevent further confiscation (CiFAR 2021:22).

When they have not progressed to permanent confiscation, asset freezes can be subject to extraneous factors. For example, the freezing order imposed by the European Union on the assets of former Ukrainian president Viktor Yanukovych on suspicion of misappropriation of public funds was extended repeatedly. However, linked freezing orders against some other sanctioned officials associated with Yanukovych were lifted, reportedly due to a lack of effective cooperation between investigators in Ukraine and foreign counterparts (Brun et al. 2021: 145-146).

Switzerland’s regime

Switzerland’s asset-freezing sanction regime was inaugurated by the Foreign Illicit Assets Act (FIAA), adopted in 2016. Under the act, the federal council can issue ordinances to freeze the assets of individuals in third countries, provided that four criteria are met.

- The third country’s government must have lost or be in the process of losing power.

- The estimated level of corruption in the third country must be high.

- It must be likely the assets were acquired via criminal means.

- The freezing must be necessary to safeguard Switzerland’s interests.

This power was used to freeze the assets of suspected corrupt figures following the political transitions in Egypt and Tunisia.

The FIAA is arguably clearer than many comparable instruments on how to move from freezing to confiscation. It mandates Swiss law enforcement upon the issuance of the freezing ordinance to initiate legal cooperation with the third country to confiscate assets and to provide technical assistance in this regard. Furthermore, should this legal cooperation fail, the FIAA enables Swiss authorities to unilaterally investigate and prosecute the person whose assets have been frozen.

(CiFAR 2021:9-10; Oldfield 2022)

In conclusion, asset-freezing sanction regimes are largely spearheaded by executive rather than judicial authorities and can be effective in swiftly freezing assets. However, such sanctions may be vulnerable to abuse and in practice provide a limited basis for further confiscation and recovery following a legal route.

Urgent freezing measures

Stephenson et al. (2011: 54) explain that any delay in executing a freezing request can prove decisive and give suspects more time to relocate their assets. For example, they note that if a foreign jurisdiction requires that criminal charges are filed against a suspect in order to respond to an MLA request, this may effectively serve to notify that suspect of the impending action and trigger asset movement.

The OECD (2021) recommends that competent authorities “be able to execute rapid freezing orders within 24 and 48 hours”. However, Wadlinger et al. (2017: 645-646) caution that the precise timing of the freezing order is context specific. If it is issued too late, the assets may be moved, but if too early, the suspect may refrain from further activity, making it more difficult to gather evidence against them.

Therefore, some countries embed urgent freezing powers in law. Aside from the aforementioned FIAA, which allows the Swiss Federal Council to swiftly freeze assets, Switzerland’s criminal procedure code empowers competent authorities to urgently freeze assets if there is an expectation they will eventually be subject to confiscation. Where there is a risk of significant delay, law enforcement can even provisionally freeze and seize assets on behalf of the public prosecutor (Dornbierer 2024: 19).

Even though urgent freezing is not a novel concept, as it is well recognised at the multilateral level, the FATF (2023) notes that “the power to suspend or withhold consent to transactions and freeze and seize expeditiously” is a critical step towards successful asset recovery. Nevertheless, there has arguably been a lack of clarity on how to execute it in practice, making it a largely uncommon practice.

For example, Article 54 (2) (a) of the UNCAC calls on signatory states to:

“Take such measures as may be necessary to permit its competent authorities to freeze or seize property upon a freezing or seizure order issued by a court or competent authority of a requesting State party that provides a reasonable basis for the requested State party to believe that there are sufficient reasonable grounds for taking such actions and that the property would eventually be subject to an order of confiscation.”

The UNODC (2015) surveyed global asset recovery cases and found that freezing or seizing property in line with Article 54 (2) (a) is not a common action. They note that requested states may not consider the freezing order issued by the requesting state as providing reasonable grounds that the assets are in fact proceeds of corruption and therefore be reluctant to proceed with the freezing.Further, the urgency of certain requests may require authorities to rely on more informal forms of requests, for example, via e-mail or a phone call (Stephenson et al. 2011: 54), which means in practice they may need to drop formal documentation requirements. In some jurisdictions, this may make such freezing orders more susceptible to legal challenges.

Montesinos Torres case

UNODC (2015) documented a case where effective communication between Peru and the Cayman Islands led to the successful urgent freezing of assets. These belonged to the former head of the Peruvian secret service Vladimiro Montesinos Torres, who reportedly amassed millions in bribes received during the 1990s to award contracts to arms dealers.

The Peruvian government issued a request to the Cayman Islands to lift secrecy protections and urgently freeze bank accounts held in Montesinos Torres’ name or the names of his associates under the jurisdiction of the accounts based in the country.

As UNODC notes, the Cayman Islands could have insisted upon a more formal procedure before freezing the accounts but elected not to in light of the urgency, as well as the fact that Montesinos Torres was at that point a fugitive, meaning a judgement in personam was not possible. Instead, the chief justice of the Cayman Islands, which acts as the country’s mutual legal assistance authority, imposed the urgent freezing request on the accounts in rem, arguing the request had provided reasonable grounds that Montesinos Torres had violated local Cayman laws by laundering the proceeds of corruption. The freezing gave Peruvian judicial authorities adequate time to collect evidence and present its case for the criminal origins of the fund, eventually leading to the repatriation of US$44 million in assets to Peru. The UNODC attributed this success to the willingness and trust of the Cayman authorities to engage with the original request.

(UNODC 2015: 43-44)

This speaks to the need for mechanisms that build trust between requesting and requested authorities, and facilitate informal means of communicating information that enable important evidence to be shared even in the absence of formal documentation. However, some concerns have been raised that urgent freezing bypasses important procedural safeguards intended to protect the presumption of innocence. Stephenson et al. (2011: 54) recommend that urgent freezing is administered in line with safeguards by, for example, ensuring the suspect can contest the freezing order and the requirement that a formal MLA request is filed to follow up on the urgent freeze within a stipulated period of time.

EU coordination mechanisms

The 2014 directive on the freezing and confiscation of instrumentalities and proceeds of crime requires EU member states to take “urgent action” to freeze assets with a view to possible subsequent confiscation (Brun et al. 2021: 142-3). EU bodies have introduced several mechanisms to enhance coordination to this effect. The European Commission established a freeze and seize task force in 2022 to enhance coordination between national authorities to enable the rapid deployment of swift asset-freezing sanctions against listed oligarchs from Russia and Belarus (Transparency International EU 2022: 2).

Council decision 2007/845/JHA requires EU member states to establish EU asset recovery offices which act as contact points at the national level on EU-wide asset recovery cases. A 2020 assessment carried out by the European Commission found that, while most member states had done so, there were still persistent delays in cross-border cooperation and overall asset recovery rates remained low.

In response, in 2023, the European Parliament agreed on new measures to expand the mandate of these offices, allowing them to urgently freeze property when there is a risk that assets could disappear. This marked a step towards the adoption of a new directive on the freezing and confiscation (European Parliament 2023).

Figure 4: logo of the EU asset recovery offices

Sourced from Report Difesa 2021.

The new measures include ensuring that asset recovery offices have access to cross-border information that “allows them to establish the existence, ownership or control of property that may become object of a freezing or a confiscation order”, including national databases collecting fiscal, commercial, citizenship and social security data. Member states will be obliged to share the requested information “as soon as possible and not later than 8 hours”. While procedural safeguards on accessing such information must be upheld, the European Parliament agreed that they should not be allowed to cause delays (EU Monitor 2023).

In conclusion, urgent freezing measures can prevent suspects from relocating their assets at short notice and are more likely to be implemented where informal communications and trust between requesting and requested national authorities are fostered. However, such authorities should respect legal safeguards when implementing such measures in order to avoid they are subject to legal challenge and overturned.

Enhancing the role of civil society organisations

Civil society organisations (CSOs) play an increasingly direct and important role in the early stages of the asset recovery process, expanding on prior work focused on research and advocacy, as well as oversight functions (Basel Institute on Governance 2020).

In terms of asset tracing, CSOs can play an important role in gathering intelligence on assets. While CSOs lack the comparative levels of access to information and the exercise of authority law enforcement is entitled to, they may benefit from other advantages such as deep regional expertise and the freedom to travel to third countries (Basel Institute on Governance 2020). Additionally, as the UNCAC Coalition (2023) points out, there are public registries such as land registries which CSOs can access to track the assets of known suspects, such as persons on sanctions lists.

Additionally, CSOs may have better access to different sources of intelligence. For example, corruption whistleblowers may be more willing to make their report, or at least initial report, to a relevant CSO rather than a law enforcement body. For example, the South African based CSO Corruption Watch collaborated with the Angolan legal aid CSO Associação Mãos Livres to collect reports from Angolan citizens on a scheme implicating Angolan public officials and Russian oligarchs (Basel Institute on Governance 2020).

CSOs can also collaborate with investigative journalists (Basel Institute on Governance 202o). Brun et al. (2021: 235) described how the German newspaper Süddeutsche Zeitung benefited from working with the International Consortium of Investigative Journalists’ network of local organisations and journalists based in more than 80 countries. This enabled the swift and context-tailored analysis of a large volume of internal documents leaked from the Panamanian law firm Mossack Fonseca, leading to the identification of suspects (and their assets) implicated in schemes to launder proceeds of corruption and tax evasion to offshore jurisdictions.

However, the Basel Institute on Governance (2020) cautions that there are kinds of sensitive evidence which CSOs are unauthorised and not well-placed to handle and that “activities carried out by CSOs should not amount to taking over the activities of the existing public law enforcement mechanism”.

In terms of later stages, CSOs can also play a more proactive role by initiating legal proceedings to freeze and confiscate assets deriving from corruption (Brun et al. 2021: 88; Basel Institute on Governance 2020). This is especially true for complex, transnational cases where the networks and specialised expertise of CSOs can be of strategic value (UNCAC Coalition 2023). However, CSOs require legal standing to initiate or participate in such proceedings and to access documentation (CiFAR 2022a: 32).

Obiang case

Teodorin Nguema Obiang, the son of the president of Equatorial Guinea and the country’s current vice president, was implicated in several corruption scandals in the 2000s and believed to have substantial assets in France. As neither French nor Equatorial Guinean authorities initiated or requested an investigation, in 2007, the CSO Sherpa filed a complaint with the Paris public prosecutor to open a criminal investigation into Obiang on the charge of “concealment of misappropriation of public funds”.

While an initial law enforcement investigation did reveal evidence of assets in France, the public prosecutor was reportedly reluctant to pursue the case and dropped charges. Sherpa, together with the CSO Transparency International France and a citizen of Gabon, then filed a civil claim as an injured civil party in 2008. Their legal standing to do so was subject to judicial review, but the cour de cassation ruled in 2010 that the claim could go ahead, which led to a further investigation against Obiang. Both CSOs actively supported the investigation by collecting evidence from various sources and sharing it with the magistrates, as well as carrying out research to identify assets linked to Obiang. The investigation eventually led to the seizure of assets valued at up to €150 million, including a luxury mansion and sportscars. Obiang was also convicted to a three-year suspended prison sentence in absentia.

The developments created momentum for amendments to the criminal procedure code of France which granted CSOs working in anti-corruption the legal standing to act as a partie civile in criminal proceedings. The involved CSOs also carried out advocacy calling for responsible management and repatriation of the assets.

Similar patterns were witnessed in the US, where the CSOs Open Society Justice Initiative and EG Justice share their expertise on corruption in Equatorial Guinea and connections to civil society advocates based in the country with Department of Justice prosecutors investigating Obiang’s alleged assets in its jurisdiction.

(Basel Institute on Governance 2020; CiFAR 2022a: 20;Brun et al. 2021: 89)

CiFAR (2022a: 28) consulted different CSOs active in the anti-corruption field and determined that the experience of French NGOs in the Obiang case was somewhat exceptional; in many other countries, the kind of legal standing they were granted is denied to CSOs. The UNCAC Coalition working group on victims of corruption maintains a database that shows which jurisdictions give CSOs legal standing in corruption related cases (UNCAC Coalition 2023).

States need to provide CSOs with an enabling environment for asset recovery work. This includes providing sustainable funding and legislation for whistleblower protection and safety guarantees for CSOs (Basel Institute on Governance 2020). However, in many countries, CSOs face restrictive contexts and insecurity that preclude them from pursuing asset recovery cases. CiFAR (2022a: 30) notes it is important for CSOs based in the countries of asset origin and location to collaborate with each other to manage such risks and bring cases forward.

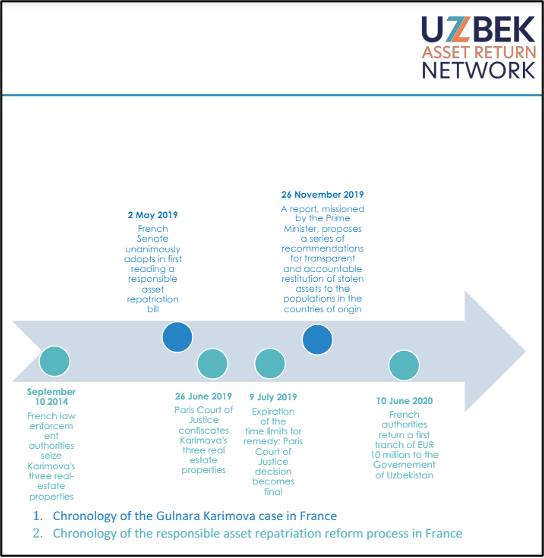

Uzbek Asset Return Network

The Uzbek Asset Return Network is a CSO created to support the recovery of public assets embezzled from Uzbekistan. Its activities have focused on assets illicitly obtained by Gulnara Karimova, daughter of the former president of Uzbekistan, Islam Karimova, as a result of reportedly taking bribes amounting to more than US$1 billion from foreign telecommunications companies.

Civic space in Uzbekistan is restricted, and CSOs working on political issues such as asset recovery can face many challenges. The network brings together CSOs and activists based both in and outside Uzbekistan, enabling the latter to undertake often more risky work.

The network performs multiple activities. Karimova’s assets are distributed across various jurisdictions and the network’s website acts as one-stop-shop for information on the various ongoing asset recovery cases, tracking developments and publishing research and advocacy content (see Figure 5).

Figure 5: an example of research published by the Uzbek Asset Return Network

Sourced from Brillaud et al. 2020.

The network has also played a more proactive role in asset recovery processes.

For example, the network supported the Swiss judicial actors with regional expertise on the nature of kleptocracy in Central Asia in their investigations and has been involved with monitoring the 2022 return of US$131 million from Switzerland to Uzbekistan via a United Nations trust fund.

(UNCAC Coalition 2023; CiFAR 2022a: 22)

In conclusion, existing evidence indicates civil society organisations can play a vital role in gathering intelligence and driving legal processes towards asset confiscation, although this potential remains largely untapped. Furthermore, they require an enabling environment from government stakeholders to play this role accordingly.

- According to Article 2(f) of the UNCAC, “‘Freezing’” or ‘seizure’ shall mean temporarily prohibiting the transfer, conversion, disposition or movement of property or temporarily assuming custody or control of property on the basis of an order issued by a court or other competent authority”. However, in some jurisdictions “freezing” and “seizure” have different connotations and are not used interchangeably.

- This estimate includes proceeds of criminal offences that are not corruption related.

- For examples of global practices to facilitate the return of assets, see: CIFAR. 2022. Best practices and challenges in the management of recovered assets; Nizzero, M. 2023. Exploring mechanisms for the return of proceeds of corruption. RUSI.